We all have the dreams of buying a car, dream house, gadgets, etc. This all can come to reality if we have a strong financial planning. One of the best options is start investing in mutual funds through a SIP (Systematic Investment Plan). So, read this article to know the meaning of SIP, how they work, and what are the benefits.

1. What is SIP?

A Systematic Investment Plan (SIP) is a mode of investment for mutual funds in which investors make regular, automated contributions periodically. With SIPs, you can plan your investments to achieve your financial goals over the long term. You can do this by determining the target amount and the amount you’d like to invest at periodic intervals in a mutual fund scheme you’ve chosen.

For instance, say you’d like to invest ₹500 each month for five years. You can set up a SIP with a mutual fund and automate your contributions for the said period. You can also choose to contribute more or less frequently. Typically, SIP mutual funds allow investing weekly, monthly, quarterly, semi-annually and so on.

It’s also important to understand the SIP meaning in mutual fund because it’s not an asset in itself, but only a mode of investing in mutual funds. Any contributions you make towards your SIP will be invested in a mutual fund scheme that you choose.

2. How does SIP Work?

Before you set up your SIP, there are a few essentials you need to know about how SIP works. If you find it easier learning through a visual mode, here’s a quick video in Hindi explaining how SIPs exactly work.

There are three stages to investing in SIP from beginning to the point where your funds are invested in a mutual fund scheme:

- Selecting a mutual fund scheme

As your first step in the SIP investment journey, you need to select a mutual fund scheme you want to invest in. If you need some help with choosing a mutual scheme, take a read through our primer on how to choose a mutual fund. - Selecting an investment frequency

The next step to your SIP investment journey is to choose an investment frequency you feel comfortable with. The most common choice, especially among salaried investors, is a monthly frequency since they receive their salary monthly. However, if you have reasons to select a different frequency, you may choose to invest weekly, quarterly, semi-annually, or annually. - Set up SIP with a mutual fund scheme

Setting up your SIP is a simple process once you’ve picked a mutual fund. On ET Money, go to your chosen mutual fund, click on invest. If you’re a first-time investor, complete your KYC and enter the bank details along with your SIP contributions and frequency, and you’re done. The process has been illustrated in detail in a later section. - Automatic debits and unit allotment based on NAV

Once everything is set up, money will be debited from your registered bank account. It will be debited each month based on the date you selected while setting up the SIP. This is an automated process. The funds will keep debiting from your bank account based on the frequency you entered while setting up the SIP.

After the money is debited, you’ll soon receive acknowledgement about your funds being invested. The acknowledgment also includes the number of units you’ve been allotted based on the NAV (net asset value). The number of units allotted for each contribution may differ because the NAV changes every day.

3. What Are the Benefits of SIPs?

SIPs offer a broad basket of benefits to investors across age groups and risk profiles. Following are some of the most prominent benefits of SIP plans:

- Rupee-cost averaging Rupee-cost averaging is one of the most prominent benefits of SIPs because it eliminates the need to time the market. Investors try to time the market by investing money based on momentary market movements and due to lack of expertise, can end up losing money in the process. SIPs take out the guesswork since it involves investing a fixed amount at predetermined intervals, regardless of the market’s position. When the markets, and consequently a mutual fund’s NAV, are low, you’re allotted a greater number of units for the amount you invest, on the other hand, you’re allotted fewer units when the markets are at a peak. Over the long term, this reduces your average cost per allotted unit. For instance, say you’ve decided to invest ₹5,000 via SIP each month for the next 5 months. Here’s how rupee-cost averaging will work in your favor for this investment:

| Asset Classes | 1-year Returns(%)* | NAV | Units [Contribution/NAV] | NAV | Units with Lumpsum |

|---|---|---|---|---|---|

| Jan | 5,000 | 100 | 50 | 100 | 250 |

| Feb | 5,000 | 98 | 51.02 | – | – |

| Mar | 5,000 | 96 | 52.08 | – | – |

| Apr | 5,000 | 102 | 49.01 | – | – |

| May | 5,000 | 100 | 50 | – | – |

| Total | 25,000 | 491 | 252.11 | 100 | 250 |

Your average NAV cost per unit comes to 98.2 [491 ÷ 5], thanks to rupee-cost averaging. If you had invested a lumpsum of ₹25,000 in January, your NAV cost per unit would have been ₹100. You’d also have been able to purchase only 250 units (2.11 fewer units, i.e., 25,000 ÷ 100 = 250 units) if you had invested a lumpsum amount.

The value of the investment would also have been different. If you had invested ₹25,000 in January, your investment’s value in May would have been ₹25,000. However, because of rupee-cost averaging, your investment’s value in May with SIPs would be ₹25,211 [i.e., 252.11 units x ₹100 NAV].

- Professional management Mutual funds are managed by experts that have a proven track experience as portfolio managers. They also have a team of research analysts at their disposal that monitor the markets and gauge investment opportunities. Since your SIP investments are investments in mutual funds, you benefit from the fund manager’s expertise. This is especially important for someone who doesn’t understand financial jargon or the markets. Instead of risking your capital, let an expert manage your money. In essence, SIPs allow you to outsource investment expertise to a fund manager who manages the mutual fund’s assets to optimize the returns for its investors. It’s a win-win.

- Financial Discipline A growth in income may trigger some to spend on upgrading their lifestyle. The wiser ones tend to do the reverse; they spend what’s left after investing. SIPs can help inculcate this discipline because you’re committing to investing a fixed amount each month. You don’t need to make an extra effort for monthly contributions either. The money is automatically debited from your registered account each month. Over time, the small contributions grow into a substantial amount because of compounding.

- Power of compounding The returns on your SIP investment, just like other mutual funds, benefit from compounding. To get some context on how powerful compounding can be, think of the returns in absolute terms. Here’s an example to illustrate the power of compounding. Say you invest ₹1,00,000 per annum. Assuming a 12% rate of return, here’s how much you’ll earn based on how long you continue investing for:

| Investment Tenure (years) | Invested Principle (₹) | Maturity Value (₹) | Absolute Returns (%) |

|---|---|---|---|

| 1 | 1 lakh | 1,12,000 | 12 |

| 5 | 5 lakh | 7,11,518 | 42.3% |

| 10 | 10 lakh | 19,65,458 | 96.5 |

| 15 | 15 lakh | 41,75,328 | 178.3% |

| 20 | 20 lakh | 80,69,873 | 303.5% |

4. Types of SIP

Now that a lot of ground has been covered on what SIP is, how SIP works, and the benefits of SIP, let’s talk about the types of SIPs you can opt for.

- Fixed SIP Fixed SIPs are the plain-vanilla version of SIPs. You choose an amount, a date till which you wish to contribute, and the rest of the process is automated. This has been discussed so far in the previous examples, but you should also know that unless you set an end date yourself, these SIPs will terminate by default in the year 2099. Given that 2099 is in the distant future, it’s not something you should worry about. Though fixed SIPs are also the most popular choice among investors, there are other types that could potentially suit your investment style better.

- Top-up SIP Top-up SIPs are great for investors who want to increase their SIP contributions periodically. An example of where top-up SIPs make a lot of sense is when your income continues to increase every year. The investor could choose to contribute the entire increment or a part thereof to the SIP by opting for a top-up SIP. For instance, if you currently invest ₹20,000 a month, and your income increases by 10% each year, you could choose to increase your contribution by the entire incremental income, a part of it, or take a simple approach and just increase your contributions by 10%.

- Perpetual SIP Perpetual SIPs are just fixed SIPs sans the tenure. Once registered, your bank account will be debited with the amount of SIP contribution unless you instruct the fund house to stop withdrawals. If you don’t want your investments to be limited to a certain number of years, perpetual SIPs are an ideal option that eliminates the need for repeated renewals. You can redeem your investments anytime you choose, of course.

- Flexible SIP A flexible SIP offers you the flexibility to change the amount per contribution or skip a few contributions if you so choose. There are two possible reasons an investor may want to change the contribution amount or skip a contribution. First, your contributions through SIP are adjusted based on the market’s overall outlook. If the market is valued higher, your monthly contributions through SIP would be reduced and increased again once markets correct and valuations look attractive. Fund houses do this based on a predecided valuation matrix. You will get to decide the minimum and maximum SIP investment amount. Please note that you’ll need to inform the fund house about these changes a week before your SIP installment is due.

5. What is the Difference Between SIP and Lumpsum?

SIPs involve periodic contributions towards a mutual fund scheme while a lumpsum investment is when you make a one-time investment in a mutual fund.

For instance, if you have ₹50,000 that you want to invest, you could either make a lumpsum investment of ₹50,000 or choose to invest ₹5,000 every month over the next 10 months by setting up a systematic investment plan.

When faced with a SIP vs lumpsum confusion, most investors will typically do better with SIPs. This is because being able to time the market is key to generating better returns from your lumpsum investment. If you make a lumpsum investment when the markets have peaked, you could end up with negative returns. However, with SIPs, you make contributions during the peak as well as when markets hit rock bottom, which eliminates the need to time the market. There are several other benefits to investing via SIPs as well.

6. Things to Consider While Starting SIP

Before you initiate your first SIP investment plan, there are a few things you should consider about the mutual fund scheme you start the SIP for.

1. Did you set goals?

It’s best not to begin investing by calling “growing wealth” your goal. Tie your investments to important milestones of your life that may require a large amount of money — for instance, a bigger home, your child’s college, or your retirement. This will help you keep tabs on your objectives, performance of how each of your investments is performing, and make it easier to take corrective action when required.

2. What’s your time horizon and risk appetite like?

Once you have a goal in mind, you know in how many years you’d want to achieve it. If you have a long time horizon, you could take on more risk than if you had a short time horizon. If you’re closer to retirement and don’t want to take on a lot of risk, you could stick to short-term mutual fund investments.

In addition to the time horizon, your risk appetite is also a factor of your income and psychological fortitude. For instance, if you have a consistent income, you may have more appetite for risk because you have a consistent cash flow coming in each month. Some investors also find it difficult to hold their investments through a sell-off. If they panic and sell while the markets drop, they may end up eroding their capital. If you believe you can’t handle the volatility of equity markets, consider sticking to debt or arbitrage funds.

3. Did you choose a mutual fund category?

This is a key consideration because there is an overwhelming number of choices here. You should consider the time horizon and your risk appetite when determining a mutual fund category.

A longer time horizon and greater risk-taking ability could give you the opportunity to earn higher returns by investing in categories like focused funds or small-cap funds. If you’re on the other end of the risk spectrum or have a short time horizon, opt for debt funds. If you’re right in between, perhaps hybrid funds would be a good choice. We have a detailed guide on how to pick mutual funds you can read to get more help with your choice.

4. Do a trial run for your strategy

Once you’ve figured all the elements out, try to do a trial run for your investment over your time horizon via an online calculator to see how much you’ll generate as returns and how much your maturity value will be. This will help you understand if your investment strategy will actually help you achieve the goal you’re investing for.

For simulating your returns, you could use a SIP calculator and planner SIP calculator and planner to see how much you’ll generate given a certain amount of monthly contribution made over a certain time and expected rate of return. You could use the tool to figure out how much you’d need to invest each month given a certain time horizon, expected rate of return, and inflation rate.

Here’s a video in Hindi that shows a simple strategy you can use to accumulate a large corpus:https://www.youtube.com/embed/G1oD9WlR4HY

7. How to Start a SIP Online on ET Money?

If you don’t know how to invest in SIP, ET Money can help with its quick, beginner-friendly three-step process.

If you prefer to watch the steps rather than read through them, here’s a video that will help you set up a SIP

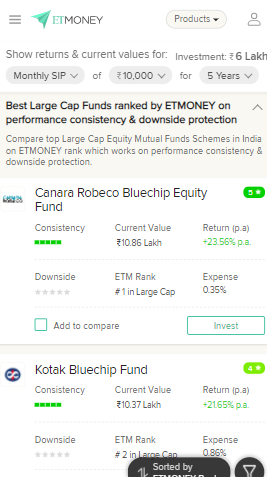

1. Choose a mutual fund

If you know how to invest in mutual funds, you’ve probably already figured this one out. If you’ve chosen a category and need help narrowing your choice down, ET Money has a fund report card to help you select from a list of top funds for each category. Once you’ve selected a fund, click on Invest now.

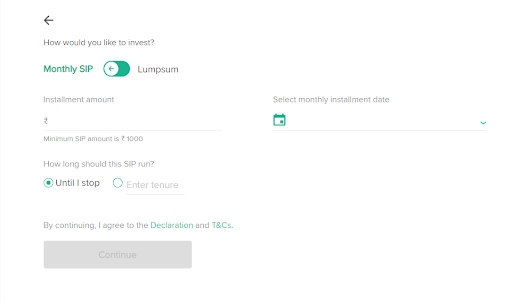

2. Select your monthly contribution and time horizon

You’ll now see a page that will ask you how much you’d like to invest each month (or you could choose to invest a lumpsum amount). If you choose SIP, you’ll also need to select a monthly installment date and the SIP tenure.

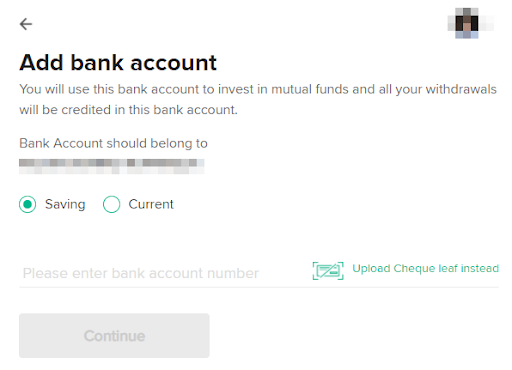

3. Next, fill in your bank account details or upload a cheque leaf if you want the algorithm to extract the details automatically. Your account will be deposited with ₹1 for verification.

… and you’re done. Simple, wasn’t it?

8. Which Are the Best SIP funds?

The best SIP funds for an investor depend on several factors like the investor’s risk profile and the fund’s return consistency, among others. As of this writing, the following are the best SIP mutual funds to invest in:

- Quant Active Fund

- PGIM India Flexi Cap Fund

- Parag Parikh Flexi Cap Fund

- UTI Flexi Cap Fund

- Mirae Asset Emerging Bluechip Fund

9. Final Thoughts

Starting SIP could be one of the most rewarding parts of your investment journey. It gives you ample flexibility and minimizes the time and effort you’d otherwise need to put into managing your investments. If you’re young, now is a good time to start your SIP. Remember, time is on your side; make the most of it.

10. Frequently Asked Questions

Unlike FD, Systematic Investment Plan (SIP) is not an investment product. It’s a method to invest systematically in mutual fund schemes. Now, bank FDs give assured returns, but they barely beat inflation, especially if you take into account post-tax returns from FDs. On the other hand, Mutual Fund SIPs can comfortably beat inflation.

To find the best mutual fund SIP, you need to be clear about your objectives. For instance, if you want to invest for more than 7 years, Equity Fund SIPs are the best fit. But if you want to invest for a short-term period, you should go for Debt Funds. Once you are sure about the category, you can choose the best scheme to start SIPs with the help of ET Money ranking.

SIP is just a method to invest in a mutual fund scheme. SIP in itself is not an investment product like FD, gold or mutual fund. So, whether an SIP is safe or not will depend on the scheme in which you are investing.

When you invest in SIP, every installment is a new investment. So, the ideal way to measure SIP returns is to calculate XIRR, which is essentially the average annual return of each of your installments. If you want to calculate how much money you can make via SIPs over a certain period, you can use our SIP calculator.

No, Mutual fund SIPs are not tax-free. If you sell your mutual fund units at a profit, you will need to pay tax on your gains (not the principal amount). How much tax you need to pay depends on the scheme in which you have invested and the time period for which you held the mutual fund units before selling them.

Given the volatility in equities, you should look to invest in Equity Fund SIPs only for 7+ years. For 5 years, you can do SIP in Balanced Advantage Funds. As these funds invest in a mix of equity and debt, they dynamically move from one asset class to the other. They try to fall less during market corrections while capturing the market upside during rallies. You can look at some of the best BAFs on ET Money with their ranking.

You can stop your SIP whenever you want. All you need to do is go to the investment platform through which you are investing and follow the instructions to cancel the SIP.

The short answer is yes. In most schemes, you can withdraw your invested SIP amount whenever you want. The only exceptions are ELSS, Retirement Savings Fund and Children Savings Fund. ELSS has a lock-in period of 3 years, while the remaining two have a lock-in period of 5 years. As every SIP installment is considered a fresh investment, you can only withdraw after the due lock-in period. Besides, you cannot withdraw anytime from close-ended funds.

The short answer is no. Through SIPs, you are essentially investing in mutual fund schemes. So your investments can fluctuate with market volatility. In fact, if the market sees a steep fall, you may see negative returns on your SIPs. But the good thing is that historically SIPs in diversified equity funds have never given negative returns if someone has invested for more than 10 years.